Digital Commerce: How Amazon wants to conquer the retail trade

Amazon dominates the global online trade, regularly making controversial headlines in the Swiss scene and is constantly expanding its range of services. One example is Amazon Go, which is contributing in part to the revolution in US retail.

A look at the Internet giant's home country reveals the extent to which Amazon is turning stationary trade upside down: Numerous large department stores and traditional brands are struggling with the declines in sales, including JC Penny, Sears and Macy's. More and more Americans are making purchases online, where Amazon is the top dog with a market share of around 45 percent [1].

Analysts have meanwhile created a technical term for the suffering caused by the supremacy of the e-commerce giant among retailers: "The Amazon Effect". The billion-dollar company has invested a lot of money in building a complex supply and storage infrastructure in digital commerce, which today can be used to order almost all products cheaply and quickly at the click of a mouse. Amazon boss Jeff Bezos promises to sustain the turbo growth: "He wants to continue investing heavily to win even more customers from the competition [1].

Point 1: Systematic development of new business fields

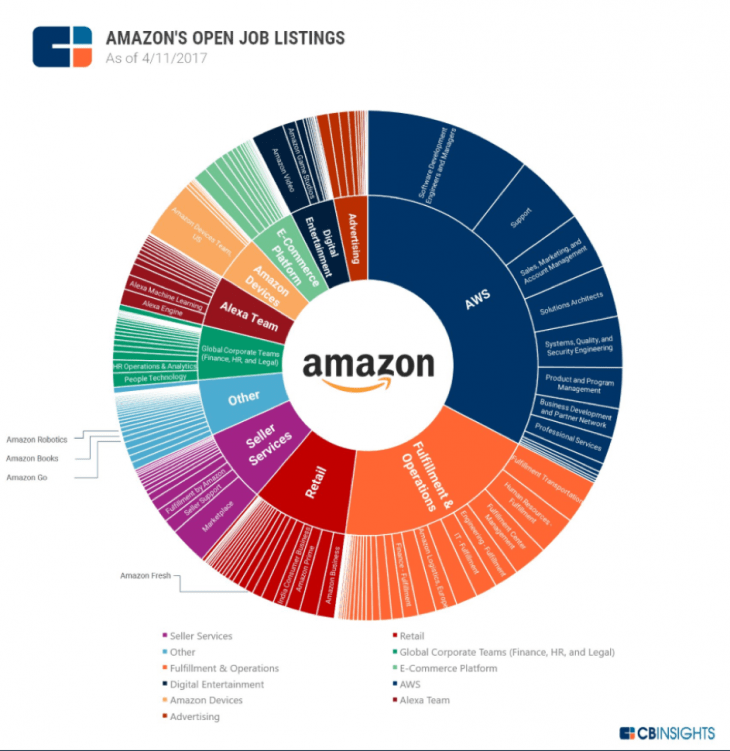

A look at the statistics on the number of vacancies per business division reveals how systematically Amazon actively conquers the retail trade (see Figure 1). Apart from the core business (AWS and Fulfillment & Operations), retail is a very important development area in which the company is building up jobs.

Amazon is going a step further even within the retail trade, taking on a sector in which the company has yet to really gained a foothold: the food sector. This is demonstrated by last year's acquisition of the American supermarket chain Whole Foods. Amazon wants to use them to build up the operational experience it needs in the food sector. Whole Foods serves Amazon as a laboratory, so to speak. Amazon now suddenly has an entire arsenal in the retail trade, i.e. high-quality own brands, a large network of shops, a delivery route including a cold chain and a solvent customer base. This experience certainly should also help in the rapid development of such concepts in Europe.

Point 2: Stay tuned, even if it doesn't work out as it should

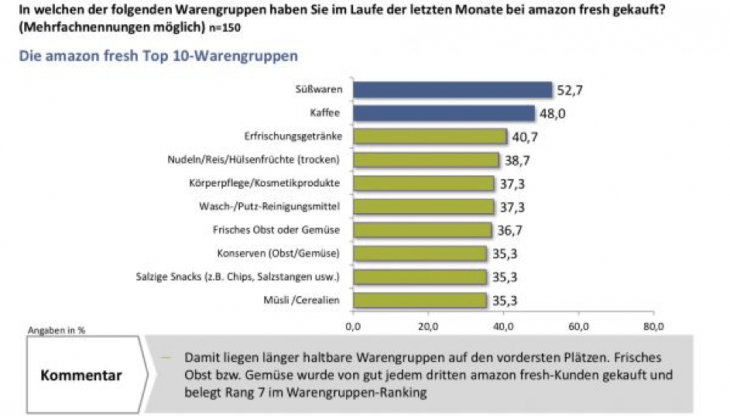

Amazon has already started its first attempts in the fresh food trade with the online food delivery service "Amazon Fresh". The German food trade has a total turnover of around 200 billion euros. However, only between 1 and 2 percent of this is realised on the Internet. The market research company Mafowerk in Nuremberg recently investigated what customers buy from the online service Amazon Fresh [2]. Approximately 2000 consumers were surveyed. It is interesting to note that more than half of the respondents bought confectionery through the service. This was followed by pasta, coffee and beverages (see Figure 2: "What do customers buy from Amazon Fresh").

But it still doesn't run really smooth. This is probably due to consumer needs. In a recent survey, consisting of 1,000 German consumers, conducted by the consulting company Oliver Wyman, 44 percent of respondents stated that they "did not trust the product quality of an online purchase of fresh produce" [3]. In particular customers avoid the online channel for fresh products such as meat, fish or green salad. Thomas Lang of Carpathia explains in detail and plausibly in his blog post "This is why fresh food is fresher online" why this is actually a mistake.

So for supermarkets, are fresh foods the last bulwark against the digital commerce rush? The fact is that fresh produce labels are (at least for the time being) highly popular in Germany and Switzerland. Milk, cheese or yoghurt sell better with the freshness seal from the regional farm. This suggests a sense of homeland and quality.

Further obstacles are too long delivery times or too high delivery costs. Now that Amazon has started the delivery service in Berlin, Potsdam, Hamburg and Munich as a pilot and in cooperation with DHL, the initial focus is on improving and expanding the existing locations and not on opening up further locations.

Point 3: Getting logistics under control

Especially in the fresh food trade, logistics is proving to be a real nut to crack - both for Amazon and for everyone else. It is in the nature of fresh produce that it quickly loses quality. Delivery must therefore take place as quickly as possible, ideally on the day the order is placed. This means that very tight time windows must be exploited. In the worst case, a van has to travel the exact same route several times a day, which is ecologically nonsensical, causes high costs and - last but not least - stimulates traffic jams on the roads, which should be avoided. There is no way around delivery costs or minimum order quantities. But the latter in particular is demotivating for customers, since many consumers wish to order small quantities for immediate consumption. Read more about logistics innovation in the next article.

Point 4: Being creative and developing new ideas

But Amazon is skilled in dealing with great challenges. New ideas and what is known as corner thinking is needed. It is possible for Amazon to, for example, break-even if the customer buys one or two non-food items with high margins in addition to the fresh produce. Amazon has a decisive competitive advantage in digital commerce here that most retailers do not have to this range.

New services that take advantage of current developments in artificial intelligence to support customers in planning their meals are expected to trigger a real boost in innovation. These include pre-prepared shopping lists, recommendations for dishes based on customer profiles or the use of Alexa, Amazon's language-based, girl-for-all, assistant. So, it would be possible to call Alexa to tell her what to put on the table in the evening and intelligent services would know exactly what is still in stock, automatically triggering orders if anything was missing for the recipe. The more information Amazon receives about customer preferences, the more likely it is that Amazon could act as a digital household and kitchen assistant. In many ways, groceries become a new data and information store. How artificial intelligence is also used in supermarkets is explained in our Insight.

Point 5: Linking online and offline

Amazon is currently testing new connections and combinations between online and stationery trading. The acquisition of Whole Foods described above clearly shows that Amazon itself is convinced that online trading alone will not be the future. Even though digital commerce is enjoying increasing popularity, it cannot offer the same haptic experience as a stationary shop. This is also confirmed by a survey conducted by the market research institute Fuhrer & Hotz. They come to the conclusion that, although almost half of the consumers, surveying from all generations, find information online, they still end up shopping in the shop [4].

And what about the Swiss market? Credit Suisse retail expert Sascha Jucker does not believe that Amazon is starting a revolution in Switzerland. "We don't expect Amazon to achieve the same dominance as in Germany," he stresses [4]. The structure of online trading in Switzerland is much more heterogeneous: in addition to Digitec Galaxus (1st place), other well-known Swiss brands such as Nespresso, LeShop and Coop@home are among the top 10 online providers in terms of sales in Switzerland (see Figure 3: the 15 online B2B providers with the highest sales in Switzerland). Swiss newcomers such as the joint venture between Swisscom and Coop called Siroop also felt that high advertising budgets alone were not enough to secure a place in this highly competitive market.

Even if Amazon penetrates the Swiss market less aggressively, the retail trade will not be spared repositioning itself in the coming years. While consumer sentiment has recovered since the Euro-Franc shock of a few years ago, retail sales are still under strong pressure. This will not change significantly in the coming year, writes Credit Suisse [4]. It's not a bad idea to follow Amazon's lead in repositioning.